Navigating typically the world of curiosity loan rates can often feel overwhelming, especially for those looking in order to secure financial stableness. Comprehending the intricacies involving how these prices work is essential for making informed judgements about borrowing cash. Whether you're obtaining a mortgage, the car loan, or even student financing, understanding what influences interest rates and how they influence your repayments can easily have an important impact on your overall financial health.

Inside this article, we will explore typically the various facets regarding interest loan costs, delving into their definitions, types, and the factors of which influence their changes. From fixed compared to variable rates to the role of typically the Federal Reserve, we'll supply you with the insights a person need to make the best choices with regard to your financial future. By simply equipping you together with knowledge about current trends, negotiation strategies, and even common pitfalls to be able to avoid, we aim to empower you on your journey to finding the right loan in the best achievable rate.

Understanding Interest Rates

Interest rates are a crucial part regarding the borrowing practice, impacting how much a borrower pays off within the life regarding a loan. Essentially, an interest price will be the cost regarding borrowing money, indicated as a proportion of the mortgage amount. The level can vary considerably based on a number of factors including typically the type of bank loan, the borrower's creditworthiness, and broader economical conditions. A reliable comprehension of interest costs helps borrowers help to make informed decisions approximately taking out loan products and managing personal debt.

For some individuals, interest prices directly influence monthly payments and overall financial planning. More significant interest rates generally lead to bigger payment amounts, which often can strain finances and affect long term financial goals. Conversely, lower interest rates can easily reduce the total cost of borrowing, letting for more flexibility and savings more than time. Identifying which in turn rate structure meets your circumstances—fixed or variable—is essential for managing costs efficiently.

Monetary institutions calculate interest rates based on several criteria, including the Federal Reserve's monetary policy, industry competition, along with the lender's assessment of chance. Rates can fluctuate, impacting not just personal loans but likewise the housing market and consumer investing. By staying well informed about what forms interest rates, debtors are better equipped to navigate their particular financial futures and seize opportunities whenever favorable rates come out.

Varieties of Interest levels

Interest rates could primarily be categorized into two styles: fixed and variable. Predetermined interest rates stay constant throughout the particular life of the loan, providing consumers with predictability inside of their monthly repayments. This stability can easily be beneficial inside budgeting and financial planning, particularly in times of fluctuating market rates. On the other hand, variable interest rates alter according to market conditions, meaning that the regular payments can raise or decrease above time. Borrowers that choose variable prices may benefit through lower initial costs, but they also face the particular risk of growing costs if rates of interest increase.

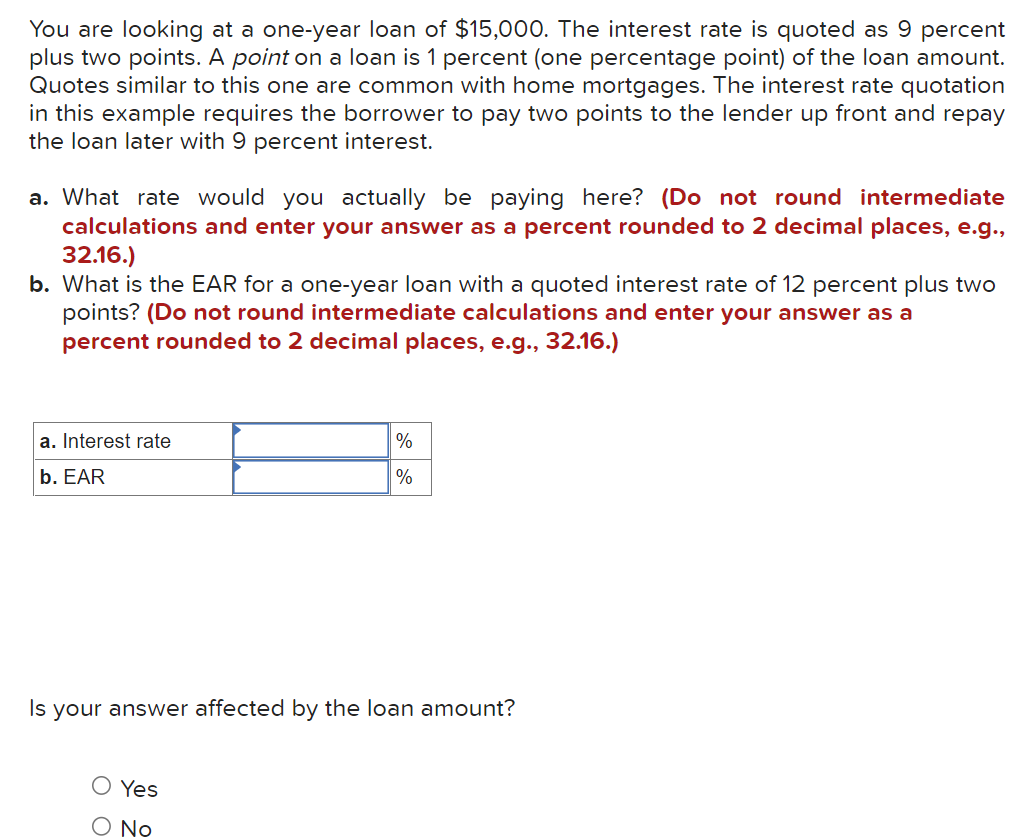

Another important type of interest rates is typically the annual percentage price (APR). APR includes not simply the attention charged on the bank loan but also any additional fees and costs associated with the loan. This specific makes APR the useful tool intended for borrowers to compare the real cost regarding different loans. The lower APR usually indicates a more favorable loan any time considering both fascination and associated expenses. Understanding the difference between the small interest and APR is critical for getting informed financial decisions.

Furthermore, special types of desire rates exist with respect to the loan type in addition to borrower circumstances. Intended for example, student loans frequently feature lower desire rates compared to other loans, together with options for deferment and even income-driven repayment plans. Additionally, zero-interest financial loans might be offered because promotional tools by simply lenders, but debtors must be cautious in addition to review your loan document thoroughly, as these types of can come with hidden costs or even stipulations. Understanding these kinds of a number of00 interest prices and their specific characteristics can allow borrowers to help to make smarter choices concerning their loans.

Strategies with regard to Securing Lower Costs

To be able to secure lower interest rates on loans, just about the most effective strategies is always to maintain a robust credit standing. Lenders usually offer better rates to borrowers together with higher credit ratings, since this reflects a reduced risk of arrears. To further improve your credit score, focus on paying bills on time, reducing spectacular debts, and limiting new credit inquiries. Regularly reviewing your current credit report with regard to errors can in addition help. Building a sound credit history over time will position an individual favorably when trying to get loans.

Another strategy is usually to consider the span of the mortgage term. Shorter mortgage terms often appear with lower interest rates compared to longer terms. While monthly payments may be higher, the general attention paid on the living of the loan can be substantially less. When feasible, opt for a loan term of which aligns with your own financial goals although minimizing the total interest cost. This method needs careful budgeting although can result inside substantial savings found in the long manage.

Last but not least, check around and compare offers from several lenders. Each financial institution has its criteria for figuring out interest rates, that may lead to diversities in offers. Simply by obtaining You can find out more by different banks, credit rating unions, and online lenders, you enhance your chances of finding a competitive level. Don't hesitate to be able to negotiate as effectively; lenders may end up being willing to fit or beat contending offers, giving an individual leverage in obtaining the perfect deal.